The "Home Affordable Foreclosure Alternative" (HAFA) program is a program for distressed homeowners to sell their homes and avoid foreclosure.

This program applies only to participating lenders who agreed to participate in the government's "Home Affordable Modification Program" (HAMP). There are currently about 100 participating lenders, including Chase, Wells Fargo, Bank of America. On February 1, certain rules were changed for these lenders (who are not Freddie Mac, Fannie Mae, or FHA/VA lenders, which are excluded from this post), which simplified some of the steps.

One change now in effect is that the property is no longer required to be owner-occupied, in fact, it may be vacant or tenant-occupied, to be eligible for a HAFA short sale, and the tenant/borrower/non-borrower occupant may qualify for the $3,000 in relocation assistance. Payment to subordinate mortgage lienholders (do you have a 2nd mortgage?) has been increased to a maximum of $8500.

Borrowers are no longer required to successfully complete an initial trial loan period or be eligible for a HAMP loan modification in order to be eligible, and the borrower may apply directly for the HAFA program.

The hardship must be verified by the borrower's lender, with no convictions relating to mortgage fraud or real estate transaction within the past 10 years. A hardship means the borrower must show, among other things, they no longer have sufficient assets to make the mortgage payment (these are not supposed to include retirement funds).

The current program cutoff date is December 31, 2013 for submission of request for a short sale, or request for approval of an executed sales contract, with conclusion of the transaction by September 30, 2014.

There are specific procedures and forms the borrower must cooperative with during the approval process, which includes about 12 steps including all borrower document submission and lender deadlines. Additional information may be requested depending on the particular loan investor on the borrower's loan.

For a more complete fact sheet on a HAFA short sale, please contact me and I will be happy to e-mail the information, plus links to informational sites.

Showing posts with label Debt Relief. Show all posts

Showing posts with label Debt Relief. Show all posts

5/31/2013

1/09/2013

Benefits of the New (and Extended) Tax Laws for 2013

Much has been written about the last-minute passage of the "fiscal cliff" issues by the federal government. But, remember there are state level issues as well, some of which are still being worked on in California., specifically SB 30.

In 2007, the new law provided, for five years, incentives for sellers to accept short sales by, in many instances, forgiving taxes that would have been due for the forgiven debt amount.

Previously, when a lender forgave a portion of borrower debt, the forgiven amount was, in many instances, considered taxable income for the borrower.

This tax incentive for sellers to participate in short sales was just extended by Congress for another year, expiring January 1, 2014; however, California's exemption under the Mortgage Forgiveness Debt Relief Act expired at the end of 2012, and currently forgiven mortgage debt is taxable state income. SB 30 (Calderon) has been introduced, and if and when passed by the California legislature, it will make California conform to federal law, and will be retroactive to January 1, 2013.

Not all debt is forgiven in every instance. Sellers should check with their tax consultant for exceptions. For example: Maximum amount that can be forgiven is $2,000,000. To be forgiven, the debt must have been used to buy, build or substantially improve their principal residence

Other housing-related provisions brought into effect with the new laws are:

Other housing-related provisions brought into effect with the new laws are:

- A 10% tax credit up to $500 for homeowners' energy improvements to an existing home, and is retroactive for 2012.

- Capital gains rates remain at 15% for incomes under $400,000 (individual) and $450,000 (joint); above those income levels gains will be taxed at 20%. On sale of principal residence, the gains rate remains at $250,000 (individual) and $500,000 (joint).

- An 2011 expired tax deduction for mortgage insurance premiums (MIP and PMI on loans) has been restored and is retroactive through 2012.

- The new "Pease Limitations", per California Association of Realtors, are at "$300,000 for married taxpayers filing jointly and $250,000 for single taxpayers (i.e., a married couple with an AGI of $400,000 would be $100,000 over the threshold; the couple’s deductions would be reduced by $3,000 which is 3% of $100,000). No matter how high a taxpayer's AGI, the Pease reduction cannot exceed 20 percent of the amount of itemized deductions otherwise allowable for the year." These were named after Ohio Congressman Don Pease and were first enacted in 1990.

- The first $5 million dollars in individual estates and $10 million for family estates are now exempt from the estate tax. After that, the rate will be 40%, up from 35%. The exemption amounts are indexed for inflation.

- More at http://www.toptennewhomecommunities.com/blog/fiscal-cliff-bill-addresses-some-key-housing-issues/

12/11/2012

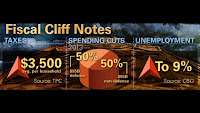

The Fiscal Cliff - or Tax Breaks That Could Be Gone

Federal income tax rates are scheduled to increase in 2013, with tax brackets currently spread from 10%-35% changing to 15%-39.6%. Long term capital gains will increase from 15% to 20%, and other long term capital gains tax rates which apply to qualifying dividends will be taxed as ordinary income.

Federal income tax rates are scheduled to increase in 2013, with tax brackets currently spread from 10%-35% changing to 15%-39.6%. Long term capital gains will increase from 15% to 20%, and other long term capital gains tax rates which apply to qualifying dividends will be taxed as ordinary income.The 2% reduction in the payroll tax for Social Security will expire, something which concerns many businesses.

Estate taxes will return to 2001 and the $1,000,000 exclusion for taxes, and the top tax rate increases from 35% to 55%. (In 2001, there weren't nearly as many $1,000,000 properties to inherit as there are now.)

Earned income tax credits, child tax crfedit and the Hope tax credit will revert to lower limits.

Student loan interest will no longer be deductable after the first 60 months of repayment.

Have you been affected by the Alternative Minimum Tax? the exemption amounts will be lowered, affecting many more individuals (a tax that was only supposed to affect the highest income earners has been affecting more and more of the middle class).

Will tax rates for income earners under $200,000 or $250,000 (households) annually change, or will the tax rates for the vast majority of Americans be impacted as well?

And, once again, there are issues about the "debt ceiling", and what measures may have to be enacted in order to allow the government to meet its obligations.

The Mortgage Debt Relief Act is also set to expire; this act is what allows short sale sellers and individuals who took out a mortgage in a certain time period and were foreclosed on under certain conditions to not be taxed on the forgiven or cancelled debt. Should this Act not be extended, the tax burden of many distressed sellers will be increased.

And, last but not least, there is the issue of whether the mortgage interest deduction will continue and in what form--In California 89% of those who took the mortgage interest deduction earned less than $200,000. Losing the deduction would cost the average California taxpayer over $3,900.

Are you concerned? I hope you are and that you contact your Congressional representative to express your opinion.

www.juliahuntsman.com

www.longbeachrealestate.blogspot.com

www.facebook.com/longbeachhomesandcondos

10/29/2012

Eliminating Your Second Lien -- Do Some Checking First

Under a new program by offered by Bank of America for home mortgage second liens, about 150,000 of its borrowers are being contacted to apply for full forgiveness. Based on the total dollar amount forgiven so far for the number of borrowers, the average is about $69,000.

If you're currently in a short sale, this could potentially cause a delay, or worse, if you're already on track for closing on the first and time is running as you approach your closing date. The release time required for completion of the second loan is running about 90 days, so accepting that release will result in a delay of your short sale, or even worse, a loss of that transaction if the investor/servicer on the first will no extend time to close.

Make sure you're really going to get freedom from a difficult mortgage burden. Say you're not in a short sale, and you receive the offer from Bank of America or one of the other major banks, make sure you get a proper estimate of your home's value from a professional. If your first loan balance is about $465,000, and your second balance is still around $45,000-$50,000 because you got an 80/10/10 loan (you had 10% down payment, and got a 10% second mortgage) getting your second loan released won't do you any good right now because it will not put you into an equity position--I forgot to mention, you just found out that at best your house is currently worth $450,000 from your neighborhood REALTOR who has checked all the sales within the last 4-6 months in your neighborhood. If releasing that lien puts you into an equity position, and you're not under a short sale timeline that cannot be extended, then the second lien forgiveness program could be for you. But make sure you read the entire letter, because if your first is currently in default and on a foreclosure track, getting the second forgiven will not prevent the first's foreclosure. That will still require separate action to stop the foreclosure (there can be different banks and/or different investors on each loan). Bank of America also makes is very clear that they are choosing who gets invited to this event, you as the borrower cannot pursue it without being invited. (It's not personal, it's just that there are many conditions affecting second mortgage liens.) The fact is, Bank of America took over Countrywide's loans, and Countrywide did a lot of "piggyback" loans, which are probably some of the seconds that are part of this offer.

It's also wise to review beforehand any possible impact to your credit score (debt cancellation may actually impact your score), reporting to the IRS, and any bankruptcy issues you may have.

If you need an estimate of value on your Long Beach, Cerritos, Lakewood, Seal Beach home, or somewhere near these cities, please contact me. If you would like more information about a short sale and you're in Long Beach, Cerritos, Lakewood, or in Los Angeles County or Orange County, please contact me.

If you're currently in a short sale, this could potentially cause a delay, or worse, if you're already on track for closing on the first and time is running as you approach your closing date. The release time required for completion of the second loan is running about 90 days, so accepting that release will result in a delay of your short sale, or even worse, a loss of that transaction if the investor/servicer on the first will no extend time to close.

Make sure you're really going to get freedom from a difficult mortgage burden. Say you're not in a short sale, and you receive the offer from Bank of America or one of the other major banks, make sure you get a proper estimate of your home's value from a professional. If your first loan balance is about $465,000, and your second balance is still around $45,000-$50,000 because you got an 80/10/10 loan (you had 10% down payment, and got a 10% second mortgage) getting your second loan released won't do you any good right now because it will not put you into an equity position--I forgot to mention, you just found out that at best your house is currently worth $450,000 from your neighborhood REALTOR who has checked all the sales within the last 4-6 months in your neighborhood. If releasing that lien puts you into an equity position, and you're not under a short sale timeline that cannot be extended, then the second lien forgiveness program could be for you. But make sure you read the entire letter, because if your first is currently in default and on a foreclosure track, getting the second forgiven will not prevent the first's foreclosure. That will still require separate action to stop the foreclosure (there can be different banks and/or different investors on each loan). Bank of America also makes is very clear that they are choosing who gets invited to this event, you as the borrower cannot pursue it without being invited. (It's not personal, it's just that there are many conditions affecting second mortgage liens.) The fact is, Bank of America took over Countrywide's loans, and Countrywide did a lot of "piggyback" loans, which are probably some of the seconds that are part of this offer.

It's also wise to review beforehand any possible impact to your credit score (debt cancellation may actually impact your score), reporting to the IRS, and any bankruptcy issues you may have.

If you need an estimate of value on your Long Beach, Cerritos, Lakewood, Seal Beach home, or somewhere near these cities, please contact me. If you would like more information about a short sale and you're in Long Beach, Cerritos, Lakewood, or in Los Angeles County or Orange County, please contact me.

Julia Huntsman.REALTOR®, CDPE, e-PRO®, SFR, Broker

and don't forget to "like" us at www.facebook.com/longbeachhomesandcondos

10/09/2012

The Mortgage Debt Relief Act Is Hanging in the Balance For Long Beach Area Owners

In 2007, the Mortgage Debt Relief Act was

passed in an attempt to help the millions of homeowners who, due to the housing

crisis and economic crash, suddenly found themselves in danger of losing their

home to foreclosure.

In 2007, the Mortgage Debt Relief Act was

passed in an attempt to help the millions of homeowners who, due to the housing

crisis and economic crash, suddenly found themselves in danger of losing their

home to foreclosure.

The act has helped many California distressed

homeowners find solutions to avoid foreclosure and opened up options to them

that were previously unavailable. This Act removed the tax responsibility on forgiven mortgage debt and allowed short sale sellers and owners of foreclosed homes to recover more quickly from selling their principal residence as a distressed property.

Although there is less coverage in the media about homeowners who owe more than their home is worth, those owners make up about 22% of the nation's homeowners.

The Mortgage Debt Relief Act, however,

was only intended to be a temporary solution and is now set to expire at the

end of 2012. This law has already been extended twice. There is a bill in Congress that would extend it again, but it is

unclear if it will pass. For distressed homeowners, this means that time is

limited to take advantage of this program.

Time is running out. But there is still a

chance to change your financial direction and avoid foreclosure. Call today to find out the current process for listing and selling your property as a short sale--the banks have streamlined their process greatly compared to the past, and limited inventory has made buyers more willing to wait for the short sale process.

Just one more thing: please don't think that if this law is not extended, that a short sale is not possible because that is not true. What it means is that the tax forgiveness period will be over, which will impact both short sales and foreclosed properties. Please remember that with a short sale, with the vast majority of properties, there is less of a loss for the bank to accept than when it is not sold and goes straight into foreclosure. Either way, the homeowner will be responsible for this difference between the bank's loss and the mortgage amount, if the MDRA is not extended.

Just one more thing: please don't think that if this law is not extended, that a short sale is not possible because that is not true. What it means is that the tax forgiveness period will be over, which will impact both short sales and foreclosed properties. Please remember that with a short sale, with the vast majority of properties, there is less of a loss for the bank to accept than when it is not sold and goes straight into foreclosure. Either way, the homeowner will be responsible for this difference between the bank's loss and the mortgage amount, if the MDRA is not extended.

Contact me, Julia Huntsman, CDPE, at 562-896-2609 and see more short sale information at www.juliahuntsman.com - Help for Homeowners.

6/06/2012

The Potection of the Mortgage Debt Relief Act Coming to End

With some recent news about positive signs in the real estate market, some owners may be taking the pressure off themselves. However, the national statistics seem to indicate that about 30% of properties nationwide are in negative equity.

With some recent news about positive signs in the real estate market, some owners may be taking the pressure off themselves. However, the national statistics seem to indicate that about 30% of properties nationwide are in negative equity.The federal Mortgage Debt Relief Act was passed at the end 2007 to allow homeowners debt relief on their principal residences if foreclosed on or sold in a short sale. California later passed a bill also helping homeowners in this situation. Currently, it is set to expire at the end of 2012, meaning that if the deadline is not extended by Congress, owners after that date will be responsible for debt after a foreclosure or a short sale. Previous to this Act, the amount forgiven in a short sale, or walked away from in a foreclosure, was treated as "phantom income" to the owner, and taxed. California's Debt Forgiveness Relief Act also expires as of January 1, 2013.

So, after December 31, 2012, if a property is approved by the bank in a short sale and sold for

7/20/2011

Good News for Short Sale Sellers and Junior Mortgages (and How Jerry Brown Used to Look)

Finally, short sale sellers in California and the Long Beach/Los Angeles County area have more protection against deficieincy judgments. Senate Bill 458 was signed into law on July 15th by Gov. Jerry Brown, effective immediately. This was previously turned down by former Governor Schwarzeneggar, but is now made part of the protections of SB 931 which was passed into law as of 1/1/2011.

This means that if you have a second loan on your principal residence and the holder of the junior lien agrees to a short sale, there is no "deficiency judgment to be requested or rendered for senior or junior liens after a short sale of one-to-four residential units", per the California Association of Realtors. Additionally, this law does not appy in situations of fraud or waste (deliberate damage), it applies to residences, and does not apply to corporate owners, LLCs, and a few other exceptions. Previously, the protection was against first mortgages only, but is now extended to the seconds and other junior mortgages.

This means that if you have a second loan on your principal residence and the holder of the junior lien agrees to a short sale, there is no "deficiency judgment to be requested or rendered for senior or junior liens after a short sale of one-to-four residential units", per the California Association of Realtors. Additionally, this law does not appy in situations of fraud or waste (deliberate damage), it applies to residences, and does not apply to corporate owners, LLCs, and a few other exceptions. Previously, the protection was against first mortgages only, but is now extended to the seconds and other junior mortgages.

2/02/2011

Looking Down That Road: Borrowers Need to Know Their Options

For some people, the picture of this highway might represent escape. For others, it could mean taking a new direction. It's important to know how this looks to you, or someone you're helping, because it probably represents the starting point of dealing with a potentially distressed property issue.

The national average is that about 1 in 7 or 1 in 8 homeowners is facing a difficult time with their mortgage. And recent statistics were published from the 4th Quarter U.S. Census data stating that there were 18.4 million vacant homes in the U.S. (11 percent of all housing units vacant all year round). While the breakdown of rentals, foreclosures held off the market, or homes not sold, etc., is not clear, we know that many of those homes used to be occupied by people whose were foreclosed on.

Did you know that many many people allow themselves to go through foreclosure without first checking their options, which include:

The national average is that about 1 in 7 or 1 in 8 homeowners is facing a difficult time with their mortgage. And recent statistics were published from the 4th Quarter U.S. Census data stating that there were 18.4 million vacant homes in the U.S. (11 percent of all housing units vacant all year round). While the breakdown of rentals, foreclosures held off the market, or homes not sold, etc., is not clear, we know that many of those homes used to be occupied by people whose were foreclosed on.

Did you know that many many people allow themselves to go through foreclosure without first checking their options, which include:

10/23/2008

Foreclosure or Short Pay Debt? New Laws

Starting September 25, 2008, the federal income tax exemption for debt forgiven on a home loan now partly applies to California's state income taxes.

Federal law provides a tax exemption for debt forgiveness on a loan incurred for acquiring, constructing, or substantially improving a principal residence up to $2 million if the debt is discharged from 2007 through 2012.

Under the new California law, the maximum qualifying debt is $800,000, and the maximum exclusion is $250,000. The California law only applies to a debt discharged in 2007 or 2008. (Info by California Association of Realtors)

Federal law provides a tax exemption for debt forgiveness on a loan incurred for acquiring, constructing, or substantially improving a principal residence up to $2 million if the debt is discharged from 2007 through 2012.

Under the new California law, the maximum qualifying debt is $800,000, and the maximum exclusion is $250,000. The California law only applies to a debt discharged in 2007 or 2008. (Info by California Association of Realtors)

2/28/2008

Mortgage Debt Relief Bill in California: Not Quite as Forgiving

Like the housing market, debt relief is a little more expensive in California.

On the state level, Senate Bill (SB) 1055, authored by Sen. Michael J. Machado, passed the Senate Revenue and Taxation Committee on an 8-0 vote. The measure would help California taxpayers whose lenders have forgiven a portion of their mortgage debt, by allowing them to exclude the forgiven debt from their incomes for state income tax purposes. Under existing state tax law, forgiven debt on mortgages is taxable to the borrower as ordinary income for the year in which the debt is forgiven. Per the Franchise Tax Board:

"If it passes, SB 1055 will conform to specified provisions of the federal Mortgage Forgiveness Debt Relief Act of 2007 – with a notable difference. For California taxpayers, the period of excludable discharges would be from January 1, 2007, to December 31, 2008. The federal period of excludable discharges is from January 1, 2007, to December 31, 2009."

Subscribe to:

Comments (Atom)