By 2010, the Great Financial Crisis had played its course long enough for lawmakers to pass the Dodd-Frank Act. Following the first major housing crash since the Great Depression and poor economic conditions, the act paved the way for recovering the financial market by strengthening regulations and oversight. Dodd-Frank was the key to preventing the same meltdown from ever happening again while creating another issue: The Supply Crisis.

As a result of Dodd-Frank, fewer homes were placed on the market. Without high-risk adjustable mortgages, people could use their homes as a secure and unfailing hedge against inflation. Most buyers had excellent credit and great jobs and opted for fixed-rate mortgages. Since there were far fewer foreclosures and short sales, the United States national housing inventory slowly tumbled to record lows.

In response to COVID-19, mortgage rates dropped to historic lows, causing people to take advantage of a once-in-a-lifetime opportunity. For example, if a buyer desired a $5,000 payment (principal and interest) in November 2020 when the 30-year fixed rate was 3%, they were looking at a home priced just shy of $1.5 million. With today’s stubbornly high mortgage rate environment, currently hovering near 7%, that same buyer can only afford a home at $940,000. The difference of $542,500 between the two mortgage rates is enough to stop many would-be buyers from purchasing.

In a typical market, most home purchases are primarily made utilizing a mortgage, with a smaller percentage of buyers paying in cash. We can even see this in the auto industry, with financing (mortgage) and leasing (renting) being the two most popular ways to acquire a car. However, fewer people have sufficient funds to purchase a car, let alone a home.

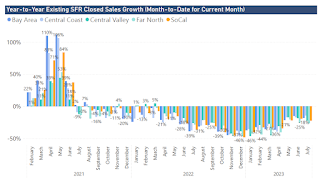

From 2022 on, we’ve seen a swan dive of a decrease in existing home sales in the United States. With limited inventory and demand due to high mortgage rates, fewer transactions can take place. As a result, smaller factors and changes become more evident to the naked eye. One will even notice how mortgage rate fluctuations dictate where supply and demand can move in the future.

As affordability deteriorates over time, fewer people can afford a mortgage, explaining why there are fewer home purchases. While taking a closer look, one will notice that cash transactions have not changed much over time, yet have become a much larger percentage of all transactions. With not as much movement in the market, cash transactions are viewed in a larger scope, causing many to think the entire market has shifted towards cash.

Thankfully, high mortgage rates are not here forever. Eventually, there will be a gradual relief in the federal funds rate, causing mortgage rates to fall, as well as rates tied to cars, credit, or any consumer loans. With enough relief, expect to see a shift in the housing market. As soon as mortgage rates dip into the 5's, even 5.99%, a new market will emerge, a tidal wave of movement. More transactions mean that cash buyers will be a smaller percentage of the purchasing pool.

In May of this year, 24.5% of all closed sales in Southern California (Los Angeles, Orange, Riverside, San

Bernardino, and San Diego) were cash transactions, approaching a quarter of the entire market. The cash purchased homes represented 3,530 out of a total of 14,381. In a normal pre-covid average (2017-2019) market, for May, there would typically be just over 19,000 home sales. That difference is 4,797 homes or 33% extra home sales. If the same amount of cash homes were bought with the pre-covid May average (2017-2019) for existing home sales, 18% of all closed homes would have been closed in cash, which tells an entirely different story. Unfortunately, many have created a negative narrative around the inability to purchase today due to the competition of so much cash in the market.

|

| PERCENTAGE OF CASH CLOSED SALES BY COUNTY : JANUARY - MAY |

Julia Huntsman, REALTOR, Broker | http://www.abodes.realestate | 562-896-2609 | California Lic. #01188996