That's Who We R®: The National Association of REALTORS®’ exciting new national ad campaign will clearly demonstrate the value of a REALTOR® to consumers, distinguish REALTORS® from other real estate agents, and deliver a sense of pride in REALTORS®.

Julia Huntsman, REALTOR, Broker |

www.juliahuntsman.com |

562-896-2609 |

California Lic. #01188996

3/13/2019

3/08/2019

Where Do U.S. Cities Rank on Vacancy Rates?

|

| Jacaranda Trees in Stearns Park, Long Beach |

Miami, Orlando, and Tampa in Florida have the highest vacancy rates, but those vacancies are also based on those areas being second home destinations, meaning they are not occupied all the time and therefore push up the percentage rate on vacancies. San Jose, Denver and Minneapolis have the lowest vacancy rates in the nation--they have strong job markets combined with an influx of millennial buyers, factors which help sellers sell, but make tougher conditions for young homebuyers.

The next four cities with the lowest vacancy rates are Salt Lake City, Portland (Oregon), San Francisco and Los Angeles with 5.55% to 5.85% vacancy rates.

But a homebuyer might want to skip Florida, and head straight to Las Vegas, which has a 14.56% vacancy rate (4th highest in the nation on this survey) and a median home price of $212,300. And speaking of median home prices, the lowest in this survey is in Buffalo, N.Y., at $135,000, with a vacancy rate of about 9%, which is the national average.

So while prices, and rents, are high on the west coast, if you are able to give yourself options, consider an area on this Lending Tree list. It may not have the weather of the West Coast, but then that's why so many people have flocked here for generations, and created all that homebuying competition.

If you still think you'd like to consider a home in the Long Beach/Los Angeles metro area, I can help you with that, just go to www.juliahuntsman.com and search for a property! Or contact me by text or phone, or email! I have 25 years of experience to help you with.

Julia Huntsman, REALTOR, Broker | www.juliahuntsman.com | 562-896-2609 | California Lic. #01188996

3/05/2019

Housing Market Review, Fewer Sales and More Listings on the Market

|

| Sales volume down in So Calif |

Another example of reduced 2018-2019 sales volume in Los Angeles and Orange Counties are in the two charts showing reduction by about 37% compared to January 2018 in LA; reduction by about 35% in OC. The median price for OC home declined $35,000--median price in LA stayed the same. INTERESTING!!

|

| Sales volume change in Los Angeles County |

|

| Sales volume change in Orange County |

In Long Beach, sales volume decreased about 5% in one year. The City of Orange had a 12% decrease in sales. But year-over-year median price home prices increased in Yorba Linda, Norwalk, Garden Grove, and elsewhere, whereas Long Beach/Lakewood have decreased by lesser amounts in price.

The essential points presented last week were:

"• Housing market conditions continue to soften | • Sales down double-digits despite recent decline in interest rates | • Price growth remains near lowest level since early 2012 | • Fundamentals are still solid | Window of opportunities for buyers"

The good news for buyers is that inventory statewide is the highest in almost 3 years. Buyers and sellers have become so accustomed to a history of lowered inventory, it's time to be reminded that a normal market is about 6 months of inventory--we're still not there! The lowest price segment of $200,000 and lower has not seen an increase, however, and many buyers need that price point. Long Beach in February, for example, had 2.5 months of inventory for single family homes, and that was a 38% increase over one year ago. We still need more units on the market. The biggest recent increase of active listings on the market is in the Bay Area, 57% higher than last year.

Advice for sellers is to be reasonable in your asking prices, it's still a very good time to sell. Buyers may take some encouragement as the inventory comes up!

Julia Huntsman, REALTOR, Broker | www.juliahuntsman.com | 562-896-2609 | California Lic. #01188996

2/04/2019

More Realistic Lender Rules for HOAs would permit more Buyers to Buy Affordable Homes

According to the National Association of Realtors, there are between 145,000 and 155,000 condominium projects in the United States. As background information, in order for FHA loans to be approved in a condo development, the entire association must be approved by HUD (per its guidelines) and this approval must be obtained every 2 years. That is a lot of paperwork for most HOAs to focus on, along with all their other usual work in maintaining their association, via their Boards of Directors. "As of January 2019, FHA has approved only 9,427 of 52,410 condominium project applications." Hence, many association in the U.S.--certainly in Long Beach--have dropped their former approvals, and sellers must now depend on buyers who obtain conventional financing. But they are losing prospective buyers, since many first-time buyers opt for FHA loans for a variety of reasons.

According to the National Association of Realtors, there are between 145,000 and 155,000 condominium projects in the United States. As background information, in order for FHA loans to be approved in a condo development, the entire association must be approved by HUD (per its guidelines) and this approval must be obtained every 2 years. That is a lot of paperwork for most HOAs to focus on, along with all their other usual work in maintaining their association, via their Boards of Directors. "As of January 2019, FHA has approved only 9,427 of 52,410 condominium project applications." Hence, many association in the U.S.--certainly in Long Beach--have dropped their former approvals, and sellers must now depend on buyers who obtain conventional financing. But they are losing prospective buyers, since many first-time buyers opt for FHA loans for a variety of reasons.HUD has been asked to lengthen the recertification process time, as well as loosen up on other items such as owner-occupancy requirements. Currently, 50% owner occupancy is required for FHA loans, but HUD is being asked to reduce that to 35%--because many HOAs do not have rules about how many rentals are allowed, and lower owner occupancy ratios are excluding buyers bringing FHA loans with them. Also, HUD restricts the number of FHA loans allowed in a project to a very low percentage, but eliminating that rule would allow more buyers to buy. In the past, "spot approvals" were allowed, meaning one unit could be approved for an FHA loan in a non-approved building, as long as that HOA met certain criteria. Spot approvals are once again being requested, again, this would increase homeownership. The two-year approval period is asked to be increased to five years, this would vastly help Boards of Directors and sellers alike.

Given the almost daily appearance of lack of affordability for buyers in the newsfeed, an opportunity to buy a condominium, which is a lower sales price market compared to houses in many areas, is an opportunity for homeownership for all.

If you are interested in a condominium purchase, or finding out about the features of condo owership, please contact me via phone or email. I am familiar with condos, and would be happy to share my information with you.

Julia Huntsman, REALTOR, Broker | www.juliahuntsman.com | 562-896-2609 | California Lic. #01188996

1/25/2019

Sales Volume, But Not Price, Down in Los Angeles and Orange Counties in 2018

|

| Los Angeles County Median Sales |

LA County sales for both single family homes and condominiums declined about 40 percent in 2018, and the same for Orange County.

Yet the median sales prices increased.

The price increase is also predicted for 2019, at a lower rate in some price categories. The market under $600,000 continues to be the most competitive and sells more quickly.

Interest rate hikes are likely to be left alone for a while, and the Mortgage Bankers Association currently reports the highest level of mortgage applications since 2010.

In the continuing competitive real estate environment, buyers must be totally prepared with a complete loan pre-approval from a qualified lender, while sellers are advised to be realistic in pricing of properties.

|

| Orange County Median Sales |

Julia Huntsman, REALTOR, Broker | www.juliahuntsman.com | 562-896-2609 | California Lic. #01188996

1/15/2019

Time to Update Your Home Appliances for Water Conservation

| |

| Jan. 1 2019 deadline |

Beginning in 2017, all single family homes were required in California to install water conserving plumbing fixtures, i.e., most commonly faucets, showerheads and toilets.

And what exactly are the requirements? SB407 puts it this way, so look for toilets (really, they've been on the market for a long time now) that are not more than 1.6 gpf, and so on:

“Noncompliant plumbing fixture” means any of the following:

(1) Any toilet manufactured to use more than 1.6 gallons of water per flush.

(2) Any urinal manufactured to use more than one gallon of water per flush.

(3) Any showerhead manufactured to have a flow capacity of more than 2.5 gallons of water per minute.

(4) Any interior faucet that emits more than 2.2 gallons of water per minute."

Here is the link to the law on plumbing fixtures replacement as passed in 2009 which set the deadlines and requirements for California properties: SB 407

But what if you sell your condo or house and you haven't complied with the law yet? Just be aware that the seller must disclose to the best of his/her knowledge if such fixtures have or have not been installed. The lack of such fixtures is not a condition of sale according to the law, but you will still be in violation of the law, and the buyer may really wish for the seller to take care of this before the close of escrow, it all depends.

But considering years of water drought, and the necessity of cutting back on water usage throughout the state, it's really best to comply with the law--everyone has been given 10 years!!

Also, cities may have stricter standards than what the state requires, so check your local municipality, such as Los Angeles, San Francisco, and San Diego, which do have point of sale requirements.

At this point I'm not aware that Long Beach has more stringent requirements than the state. The City is, however, offering a rebate if you give up your 1.6 gpf toilet and get a .8 gpf toilet http://www.lbwater.org/Rebates -- see a list to download on approved fixtures. More information on the City's water program is currently on their website: http://www.lbwater.org/Residential%20Conservation

See prior post: 2017 post on low-flow toilets

Lastly, for more complete information, I will be happy to share a complete up-to-date posting from California Association of Attorneys legal section about this law, to clarify any questions about how to negotiate with your buyer on this subject, and more. Just call or email me with your specific question and contact information. If it turns out I think you're a non-California property owner in China, I'm probably not going to respond.☺

Julia Huntsman, REALTOR, Broker | www.juliahuntsman.com | 562-896-2609 | California Lic. #01188996

1/09/2019

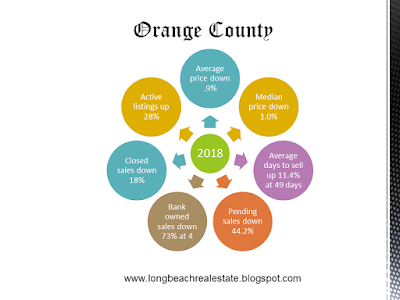

Orange County, 2018 Year in Review

|

| OC Single Family Homes 2018 |

This chart is only for single family homes in Orange County, no condominiums are included.

This is the overall picture from December 2017 to December 2018; the market in the OC had higher peaks during the summer and fall. Overall, however, the lower number of pending sales, meaning fewer properties are in escrow, is much less than one year ago and has been on a steady decline since a peak month in May, 2018.

Sales prices overall have not changed significantly, and it's still a good time for sellers to put their properties on the market.

For a confidential valuation of your property, please contact me. I make it easy for you to get decisive information about putting your property on the market.

Julia Huntsman, REALTOR, Broker | www.juliahuntsman.com | 562-896-2609 | California Lic. #01188996

1/07/2019

Los Angeles County, 2018 Year in Review

|

| 2018 Year in Review for LA County |

This chart for 2018 is for single family homes only, it does not include condos.

Los Angeles County prices continue upward, albeit at a slower pace, while sales volume continues down.

The gap between original list price and sales price is widening a little to about 3% on a county wide basis.

Please contact me for confidential help on selling your property!

Julia Huntsman, REALTOR, Broker | www.juliahuntsman.com | 562-896-2609 | California Lic. #01188996

12/04/2018

Average Sales Prices Mostly UP in Selected Long Beach Areas, Signal Hill and Lakewood for 2018

Lately, the internet is full of stories about softening prices, but it turns out to not be all true. It depends on the city and overall region. But take a look at these stats, taken directly from the CRMLS, which happens to be the largest MLS in the country with 96,000 subscribers and another 143,000 agents in participating MLS's.

Lately, the internet is full of stories about softening prices, but it turns out to not be all true. It depends on the city and overall region. But take a look at these stats, taken directly from the CRMLS, which happens to be the largest MLS in the country with 96,000 subscribers and another 143,000 agents in participating MLS's.Below are the average sales prices for single family homes, with the sales count for that period in parentheses ( ). It was a little different than I expected--I chose these areas in Long Beach as representative of single family homes for different points in the city, and then chose Lakewood and Signal Hill as entire cities.

As you will see below, in most cases, for 2018, both average sales price and sales volume increased in the second 5 months of the year, compared to the first 6 months--not what I expected to see, especially in the highest price area of the city where properties are spending more time on the market.

Long Beach

Area 1 - Naples, Belmont Shore/Park, Marina Pacifica, Bay Harbor - UP

1/1 - 6/1 -- $1,220,951 (71)

6/2 - 12/1 -- $1,588,024 (90)

Area 2 - Belmont Heights, Alamitos Heights, Bluff Park - UP

1/1 - 6/1 -- $996,377 (44)

6/2 - 12/1 -- $1,106,803 (63)

Area 5 - Wrigley Area - UP

1/1/ - 6/1 -- $538,908 (50)

6/2 - 12/1 -- $574,446 (63)

Area 6 - Bixby, Bixby Knolls, Los Cerritos, California Hts - MIXED

1/1 - 6/2 -- $760,435 (101)

6/2 - 12/1 -- $749,131 (107)

Area 7 - North Long Beach - UP

1/1/ - 6/1 -- $447,282 (100)

6/2 - 12/1 -- $464,851 (165)

Areas 31,32,33,34 - Los Altos, Conant, Ranchos, Plaza, Stratford Square - UP

1/1/ - 6/1 -- $696,026 (187)

6/2 - 12/1 -- $716,253 (252)

City of Signal Hill - UP

1/1/ - 6/1 -- $747,303 (27)

6/2 - 12/1 -- $872,874 (23)

City of Lakewood - UP

1/1/ - 6/1 -- $589,653 (314)

6/2 - 12/1 -- $612,165 (401)

If you are interested in selling for 2019, or would just like some idea at this point of your market value, please contact me directly via text, phone or email.

Julia Huntsman, REALTOR, Broker | www.juliahuntsman.com | 562-896-2609 | California Lic. #01188996

12/03/2018

California Conforming Loan Limits Increased

Fannie Mae and Freddie Mac have increased the 2019 conforming loan limits, to match the increasing market which is higher than the national average.

Mortgage loan limits on loans acquired by Fannie Mae and Freddie Mac are increased to $484,350 on one-unit properties and a cap of $726,525 in high-cost areas. The previous loan limits were $453,100 and $679,650, respectively.

Not all California counties will have the same upper loan limit, however, Los Angeles, Alameda, Orange, and other Bay Area counties such as San Francisco County will have the highest cap of $726,525 for one unit, and up to $1,397,400 for 4 unit residential properties. See California county loan limits.

Julia Huntsman, REALTOR, Broker | www.juliahuntsman.com | 562-896-2609 | California Lic. #01188996

Mortgage loan limits on loans acquired by Fannie Mae and Freddie Mac are increased to $484,350 on one-unit properties and a cap of $726,525 in high-cost areas. The previous loan limits were $453,100 and $679,650, respectively.

Not all California counties will have the same upper loan limit, however, Los Angeles, Alameda, Orange, and other Bay Area counties such as San Francisco County will have the highest cap of $726,525 for one unit, and up to $1,397,400 for 4 unit residential properties. See California county loan limits.

Julia Huntsman, REALTOR, Broker | www.juliahuntsman.com | 562-896-2609 | California Lic. #01188996

Subscribe to:

Comments (Atom)