Interest rates are climbing again, today they are up to 8%, the highest

rate in decades. While buyers should realize there are other things to

keep in mind about buying besides the interest rate, such as the chance

to build equity, sellers also need to keep in mind how interest rates

are affecting asking prices in some areas, and what to expect in an

offer from the buyer.

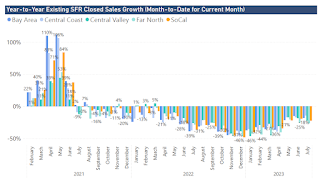

To see the impact on both sides of the transaction, the Purchasing Power Calculator gives an immediate picture of monthly payment, number of properties available, reduction or increase in asking price, and information gathered from California counties' markets.

Buyers should keep in mind that interest rate is also impacted by credit scores, type of loan, and other factors. The purpose of this calculator is to give an immediate picture of choices, both housing inventory-wise and financially.

Just click on the link to see the calculator.

For more assistance, please contact me via text, email or phone call. For a property search, go to my website.

Julia Huntsman, REALTOR, Broker | http://www.abodes.realestate | 562-896-2609 | California Lic. #01188996