There is a great deal of talk lately about the upward climb in sales, that maybe we're seeing the bottom of the market, and that prices are down from this time last year, but it's the 5th straight month of sales increases, and the best sales record in several years . . . so maybe prices are stabilizing, or even headed up a little? That's happening in some places, and yesterday's great REO panel of experienced brokers even said it's impossible to underprice a property today because it will get multiple offers and sell for more.

But take a look at the Credit Suisse chart at the right and the pink part of the graph--the reset of the "option adjustable rate" loans. Those are the loans where the "start rate" of 1% were thought by many borrowers to be their permanent loan rate, and not the introductory rate which if always paid at that payment level (and most people did that), meant the remainder of the interest of the real interest rate was added on to their principal loan amount and thus increasing it. It was one more way to end up "under water" on the home value, and end up as a loan modification customer, a short sale candidate, a bankruptcy claimant, and/or as a foreclosure recipient. And then, most importantly, notice that the reset periods do not decline until well into 2012.

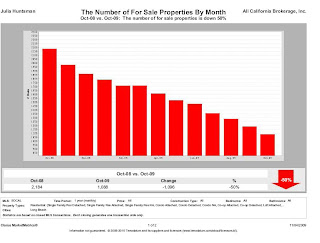

Along with the recent sales increase is declining inventory: In Long Beach today there are 877 active residential listings in the MLS, and

there are 753 in escrow. Also, as of 8/18/2009, there are 1910 Notices of Default filed, 1224 Trustee Sales filed, and 1426 REO properties, not on the market yet, making

a total of 4,560 properties not yet on the market. (Some of the NODs may have successful loan modifications, but there is also a separate study of the percentage of loan mods that end up failing and do end up in foreclosure.) These figures are for Long Beach alone--similar profiles could be drawn for cities throughout the State of California.

Tied in with this is the talk of "shadow inventory" and the rumors that banks will flood the market with all of their pent-up inventory at once. But that is unlikely to happen in such an overt way, despite the hope of many prospective buyers who believe a $400,000 house might eventually sell for $25,000. Received yesterday in my e-mail from DSnews.com:

Perhaps it’s “government pressure to clean up balance sheets,” or the thawing out of home sales, the need for capital, or the growing pool of players in the mortgage-backed assets market. Whatever the motivation, more banks are beginning to unwind their positions in toxic residential loans.

See this story about a

Milwaukee-based bank that sold 800 troubled Arizona mortgages to an undisclosed investor, thus clearing $297 million of bad loans from its balance sheets. Will this trend catch on with major banks who decide to sell off in bulk to cut their losses? There seems to be more interest now by investors willing to acquire properties associated with "toxic loans".

The current shrinking inventory may be a combination of things: the loan modifications, the foreclosure moratoriums which have been delaying filings, and the ultimate decisions by banks as to the handling of foreclosed properties, plus the "catching up" with loans in default for months and that are yet to go into foreclosure. Those involved with the REO market believe that over time, perhaps as soon as in a few short months, the inventory will once again increase greatly, continuing to affect housing market prices, and the real estate market will not fully recover from the effects of the subprime market until 2012-2014, as indicated by the chart above.

So what should equity sellers do? Take advantage of this period of time, and realize that now, when there is less competition and many cash buyers (accounting for one-third of the multiple offers on many REO properties), may be a better time to sell than a year from now, when you could end up being a short sale if your equity continues to decline with the market. In some areas short sales and bank-owned properties already dominate the inventory; in the last year certain zip codes that seemed immune, or less impacted, to these issues are now common, such as:

- In 90803, 23% of the 177 active and pending listings are distressed sales

- In 90802, 68% of the 280 active and pending listings are distressed sales

and in the future, if the local and statewide foreclosure statistics are any indication, distressed sales will impact equity sales even more severely than they are now.

If you would like to know about the current market value of your home, please contact me. To see properties on the market in your area, you may search by zip code or city, price, etc., at the MLS property search button at http://www.juliahuntsman.com/.