|

| Sales volume down in So Calif |

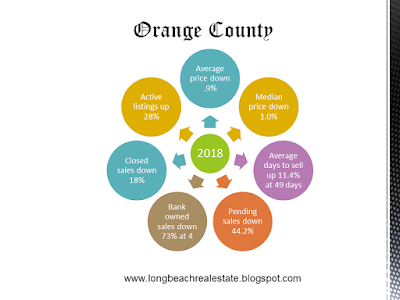

Another example of reduced 2018-2019 sales volume in Los Angeles and Orange Counties are in the two charts showing reduction by about 37% compared to January 2018 in LA; reduction by about 35% in OC. The median price for OC home declined $35,000--median price in LA stayed the same. INTERESTING!!

|

| Sales volume change in Los Angeles County |

|

| Sales volume change in Orange County |

In Long Beach, sales volume decreased about 5% in one year. The City of Orange had a 12% decrease in sales. But year-over-year median price home prices increased in Yorba Linda, Norwalk, Garden Grove, and elsewhere, whereas Long Beach/Lakewood have decreased by lesser amounts in price.

The essential points presented last week were:

"• Housing market conditions continue to soften | • Sales down double-digits despite recent decline in interest rates | • Price growth remains near lowest level since early 2012 | • Fundamentals are still solid | Window of opportunities for buyers"

The good news for buyers is that inventory statewide is the highest in almost 3 years. Buyers and sellers have become so accustomed to a history of lowered inventory, it's time to be reminded that a normal market is about 6 months of inventory--we're still not there! The lowest price segment of $200,000 and lower has not seen an increase, however, and many buyers need that price point. Long Beach in February, for example, had 2.5 months of inventory for single family homes, and that was a 38% increase over one year ago. We still need more units on the market. The biggest recent increase of active listings on the market is in the Bay Area, 57% higher than last year.

Advice for sellers is to be reasonable in your asking prices, it's still a very good time to sell. Buyers may take some encouragement as the inventory comes up!

Julia Huntsman, REALTOR, Broker | www.juliahuntsman.com | 562-896-2609 | California Lic. #01188996